The latest round of STAC conferences in Chicago, London and New York just concluded – it’s an event we attend every year to connect with the brightest and most innovative Financial Services organizations. DDN was grateful to participate in the “Building a ML Factory” panels at each of the events as this was a very hot topic across the board. During the panel there was a lot of discussion about how businesses can effectively scale Machine Learning projects from proof of concept to fully industrialized applications built for growth.

There were conversations about standardizing tools but maintaining flexibility to allow for innovation, fostering an environment that embraces experimentation, and managing infrastructure to ensure costs are well understood and managed. Time and again, the conversation swung towards how aligning data strategy with business strategy will increase the likelihood of success and create a model that scales.

What are the components of a successful and scalable data strategy?

- First, you need to be able to identify what data is needed: determine what data is business-critical, understand where that data is today, identify how new data will be gathered and how it will be organized. Examine how the business should balance processing at data origin with data aggregation and centralized computing.

- Second, apply appropriate data governance: If you’re building an AI model that will make recommendations about customer risk, you must be able to explain how the model is trained and using data reliably. For financial companies data privacy, legality and responsibility must be a foundational part of any AI data plan.

- Third, it’s important to have the right people accessing the right tools. To build knowledge and create multiplicative effects, make it easier for data scientists and data teams to share knowledge and collaborate, while maintaining strong access controls.

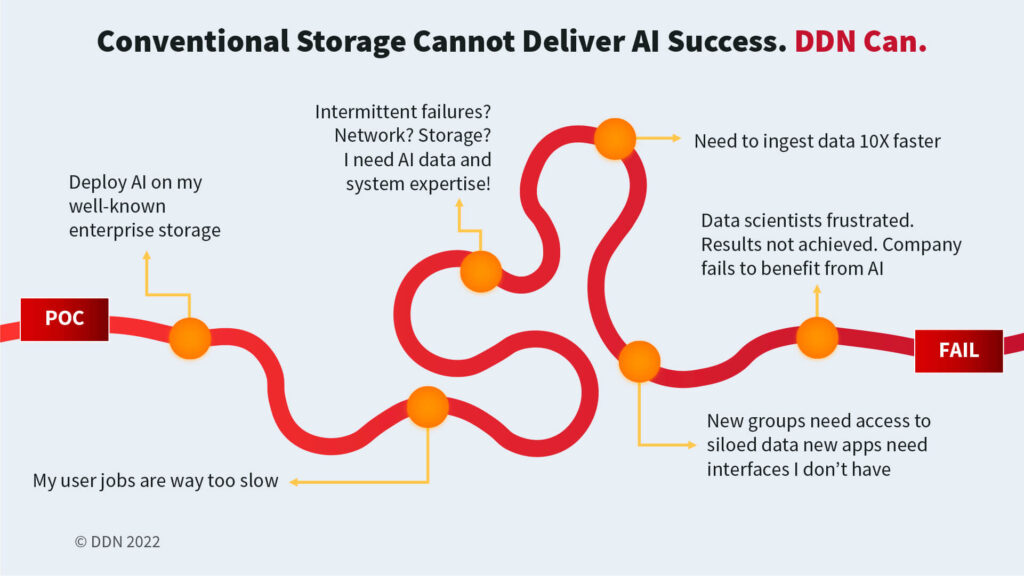

- Finally, ensure you have the right platform that reduces complexity, process data efficiently and maintains flexibility. Many projects fail because of data bottlenecks or because your network and devices cannot process data at scale. Regulatory compliance is simplified with a streamlined data architecture.

DDN understands the complex choices that face financial institutions and supplies transformative solutions that deliver a comprehensive approach to data management. With performance, effortless scalability and flexibility built in, DDN will help you create an environment that fosters innovation today and is a sustainable foundation to for meeting future customer needs.

Please Contact DDN today to discuss how better data management data can be a catalyst for change in your organization.